do i pay taxes on an inherited annuity

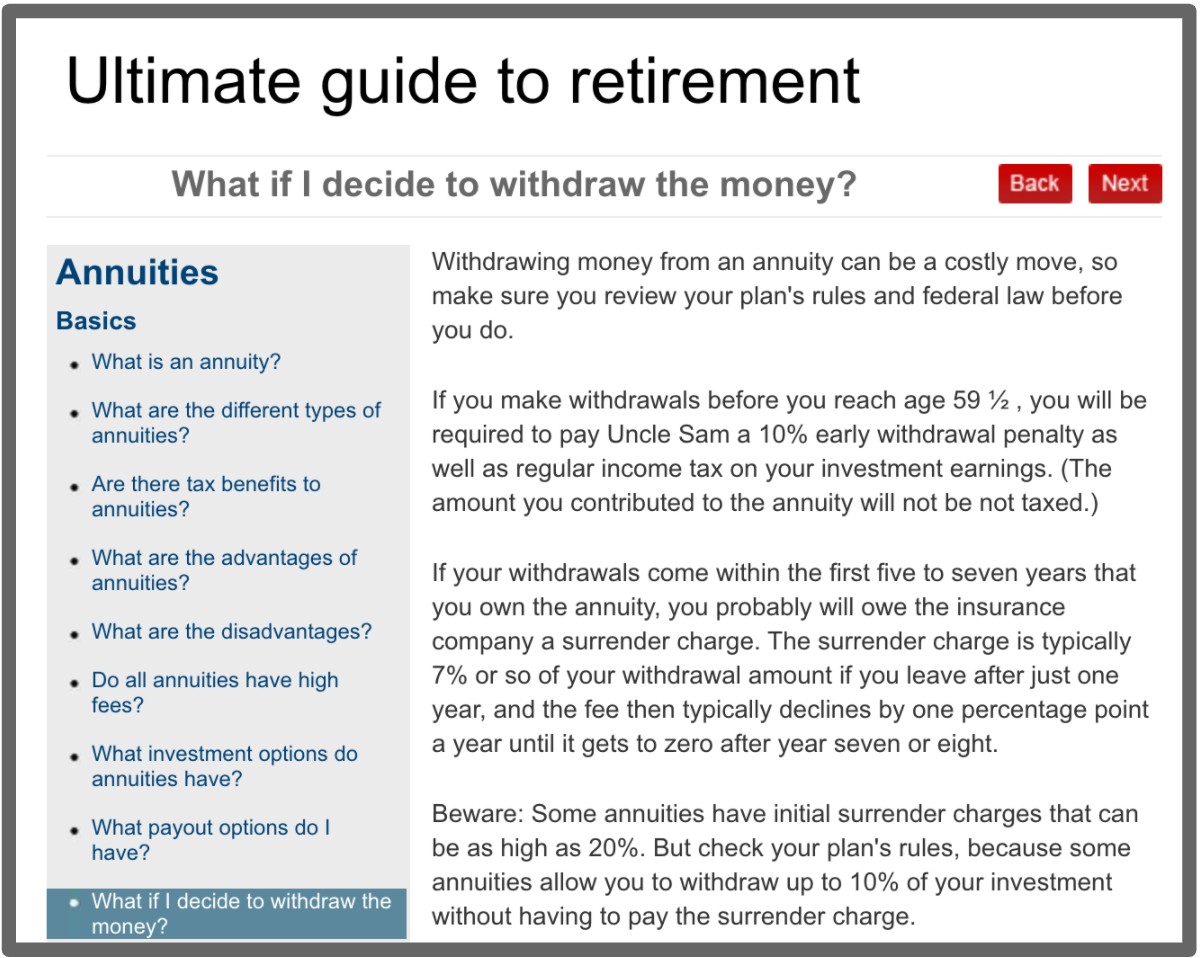

The funds in an annuity can grow tax-deferred until you decide to withdraw the untaxed portion. In this case taxes are owed on the entire difference between what the original owner.

Annuity Beneficiaries Inheriting An Annuity After Death

If you are the beneficiary and inherit an annuity the same tax rules apply.

. Posted on Dec 10 2013. However how the taxes add up depends on the beneficiary and how the annuity has been structured. Whether a retirement account characterized as an annuity by the provider is exempt from.

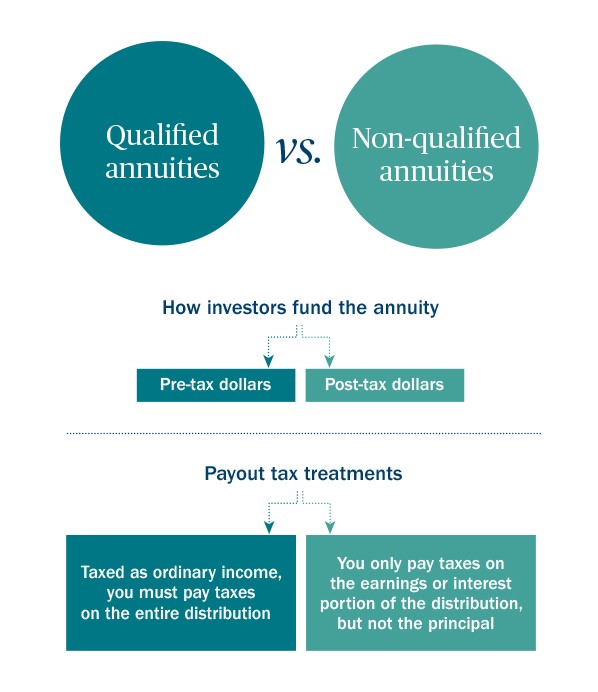

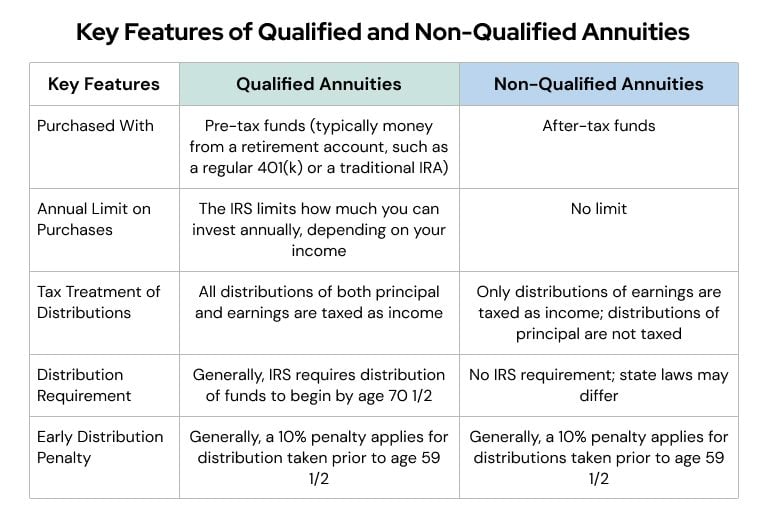

Yes there are taxes due on inherited annuities. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded. You may have to pay income tax on the distribution based on the type of plan.

In other words you have to pay ordinary income tax on the earnings part of your distributions. If a beneficiary opts to receive the money all at once he or she must pay taxes. So if you were the.

1099-R inheritance tax treatment depends on whether it was inherited from a spouse or not. Pennsylvania Inheritance Tax. SearchStartNow Can Help You Find Multiples Results Within Seconds.

Ad Search For Info About Are inherited annuities taxable. Taxation of Annuity. SearchStartNow Can Help You Find Multiples Results Within Seconds.

Unlike other investments the named beneficiary of a nonqualified annuity does not get a step-up in tax basis to the date of death. These annuities have already been subject to income tax however any. However that doesnt mean the beneficiary will have to pay.

Either way you will pay regular taxes only on the interest. If the decedent lived in one of these states at the time of death any money he left including annuities is subject to inheritance tax which is generally deducted from the amount due to the. Ad Search For Info About Are inherited annuities taxable.

The proceeds of an inheritance are taxable. Just like the owner of the annuity the beneficiary pays taxes on the funds received when the owner dies. Annuity Income Tax.

How taxes are paid on an. Estate Planning Attorney in Radnor PA. The fact that you received the.

An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. Browse Get Results Instantly. Annuities are taxed as ordinary income when inherited.

The amount depends upon your relationship to the deceased and the value of the annuity. The part of the annuity payment representing return of capital is not taxable but the earnings are. The taxes due are on only the growth and even if.

If you are inheriting a non qualified annuity the earnings are taxed as ordinary. Any beneficiary including spouses can choose to take a one-time lump sum payout. If it seems like everything is subject.

Browse Get Results Instantly. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Although you will not owe taxes on the principal or the amount your father paid into the annuity you will owe taxes on the interest the premium has earned. Do I have to pay taxes on an inherited annuity. But there is no 10 early withdrawal penalty to worry about and you dont have to.

Taxation Of Annuities Ameriprise Financial

Annuity Taxation How Are Annuities Taxed

Understanding Annuities And Taxes Mistakes People Make Due

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Beneficiaries Inheriting An Annuity After Death

What Is The Tax Rate On An Inherited Annuity

Annuity Beneficiaries Inherited Annuities Death

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

We Have Long Term Care Annuities That Double Or Triple Your Client S Premium For A Tax Free Long Term Care Benefit Annuity Retirement Planning Long Term Care

Annuity Tax Consequences Taxes And Selling Annuity Settlements

What Are My Choices With An Inherited Annuity Financial Aid For College Financial Aid Inheritance Tax

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Find The Latest Annuity And Life Insurance Solutions For Financial And Retirement Planning Email Me For Details On Annuity Retirement Planning Life Insurance

Annuity Beneficiaries Inheriting An Annuity After Death

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed