income tax rate indonesia

Generally the VAT rate is 10 percent in Indonesia. Normal rate of taxation in Indonesia corporate income is 25.

Indonesia Payroll And Tax Guide

New Progressive Income Tax Rates for 2022 07 Jan 22 From January 2022 new progressive income tax rates come into effect in Indonesia.

. The after-tax profits are subject to a withholding tax WHT ie. Review the 2020 Indonesia income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in Indonesia. Indonesia Non-Residents Income Tax Tables in 2022.

Effective fiscal year 2022 the lowest tax bracket cap for individual income tax will be increased from IDR 50 million to IDR 60 million and a new 35 tax bracket will be added for individuals earning more than IDR 5 billion annually. Corporate - Branch income. The regulation changes show further flexibility in tax liability.

Over IDR 500 million. The Personal Income Tax Rate in Indonesia stands at 30 percent. While for non-resident taxpayers are subject to final witholding tax of 20 on gross income but may be in lower rate under tax treaty.

For fiscal year 20202021 the CIT rate is 22 and for fiscal year 2022 onwards the CIT rate will be 20. Annual Taxable Income Rate. Taxable Income Tax Rate.

Small company discount. If your annual gross income is not above IDR 48 billion then you may choose in between two taxes. Personal Income Tax Rate in Indonesia averaged 3156 percent from 2004 until 2019 reaching an all time high of 35 percent in 2005 and a record low of 30 percent in 2009.

The changes include a new top individual income tax rate of 35 on income over IDR 5 billion in addition to an increase in the upper threshold for the 5 rate from IDR 50 million to IDR 60 million. The corporate income tax CIT rate in Indonesia is 25. This means that you will start to use general tax rates.

In term of tax payments individual income tax is collected through third party witholding. ICalculator ID Excellent Free Online Calculators for. PT Cekindo Business International.

Last reviewed - 22 June 2022. Branch profits tax or BPT at 20 regardless of. Companies that have a gross turnover below 50 Billion IDR have a discount on 50 from the standard corporate income tax in other words 125.

The rate of corporate income tax for example is currently set at 25 percent an 8 percent margin compared to that of Singapore. Try to calculate your personal tax for free now. Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to resident corporations and individuals.

Companies that put a minimum of 40 of their shares to the public and are listed in the Indonesia Stock Exchange offer are taxed on 20. Income Tax Rates and Thresholds Annual Tax Rate. The corporate income tax rate which was expected to be reduced to 20 will remain at 22.

This page provides - Indonesia Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Over IDR 250 million- IDR 500 million. 26 WHT of 20 is applicable.

Rp36-50 million 5 percent. Some income tax is collected through withholding taxes mechanism which the payer must withhold and submit the tax to the tax offices on a monthly. Non-resident individuals are subject to withholding tax at a rate of 20 Article 26 income tax subject to a relevant tax treaty provisions on Indonesia-sourced income.

Corporate taxpayers with an annual turnover of not more than 50 billion rupiah IDR are entitled to a 50 tax discount of the standard rate which is imposed proportionally on taxable income on the part of gross turnover up to IDR 48 billion. Income tax rate 05 from gross income General tax rate 12525 from the profit However as soon as your annual income. Resident individual taxpayers who receive or earn annual income exceeding the PTKP threshold must register with the Tax Office and file annual income tax returns personal tax.

The following is Indonesias income tax rates compared to other countries. VAT on the export of taxable tangible and intangible goods as well as export of services is fixed at 0 percent. Flat rate on all taxable income.

Taxable Income Rate Up to Rp 50000000 5 Over Rp 50000000 but not exceeding Rp 250000000 15 Over Rp 250000000 but not exceeding Rp 500000000 25 Over Rp 500000000 30. Estimate your own income tax in Indonesia for the current year through our Personal Income Tax Calculator. Withholding Tax in Indonesia.

Branch profits are subject to the ordinary CIT rate of 22. Indonesia Individual Income Tax Guide 9 Individual Tax Rates Resident Taxpayer The standard tax rates on taxable income received by resident taxpayers are as follows. However the exact rate may be increased or decreased to 15 percent or 5 percent according to government regulation.

Individual income tax rates. Corporate income tax rate PPh badan.

From Torsten Slok S P500 And Home Prices Are At Record Highs And The Unemployment Rate Is At The Lowest Level Since 2000 But On Inequality Big Picture Chart

Household Savings Meaning Formula Importance Key Factors Penpoin

Emerging Markets Most Exposed To A Sudden Stop Business Insider External Debt Marketing Emergency

Facing A Down Economy And Growing Health Concerns The U S Government Continues To Increase Federal And State Tax Rate Infographic Turbotax Infographic Health

Indonesia Income Tax Rates For 2022 Activpayroll

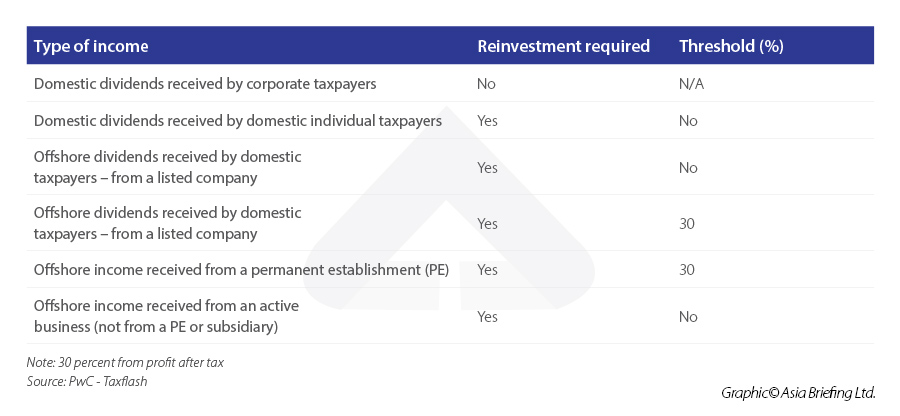

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Corporate Income Tax In Indonesia Acclime Indonesia

Indonesia Tax Reform Includes Rate Increases And Tax Amnesty Bdo

Indonesia To Introduce 0 1 Crypto Vat And Income Tax From Next Month In 2022 Income Tax Income Tax

Djp Online Adalah Cara Termudah Dan Paling Pantas Bagi Wajib Pajak Untuk Membayar Pajak Tepat Waktu Tanpa Perlu Rep Capital Gains Tax Income Tax Tax Deductions

Indonesia Income Tax Rates For 2022 Activpayroll

Indonesia Payroll And Tax Guide

Indonesia Payroll And Tax Guide

Hsn Chapter By Name Harmonized System Coding India

Www Taxfyle Com Tax Preparation Fees Pricing Tax Preparation Filing Taxes Income Tax Brackets

Mengenal 5 Jenis Pajak Di Indonesia Beserta Contohnya Income Tax Filing Taxes Capital Gains Tax